Dubai Real Estate Transactions as Reported on 5th December 2025

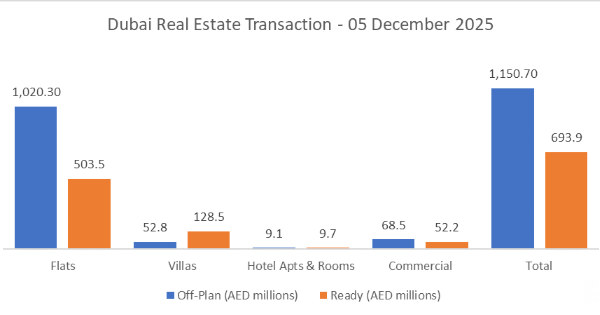

| On 4 December 2025, the total transacted value in Dubai’s property market reached AED 1.84 billion. Off-plan once again led the market with AED 1.15 billion (62.4%), while ready properties contributed AED 693.9 million (37.6%). | ||||||||||||||||||

|

Off-Plan Market Performance |

| Total Value: AED 1.15 billion (62.4% of daily total) |

|

| This profile underlines a decisively apartment-led off-plan market, with smaller but meaningful contributions from villa and commercial launches. The data suggests developers are still successfully placing mid-ticket apartment product, while niche hospitality and commercial stock remain a thin but steady slice of off-plan trading. |

Ready Market Performance |

| Total Value: AED 693.9 million (37.6% of daily total) |

|

| Ready flats remain the core of end-user and investor demand, while ready villas continue to command a notable share, reflecting ongoing interest in established communities and move-in-ready family homes. Commercial and hospitality assets form a modest but stable share of daily liquidity. |

On The Micro Level |

| Today’s trading pattern is relatively balanced, with no single asset class or sub-category distorting the market. Instead, it shows a healthy spread: robust flows into off-plan apartments, backed by solid, broad-based demand for ready flats and villas across multiple communities. |

Market Insights & Outlook |

| The 62.4% share of off-plan value confirms that Dubai’s market is still firmly in a development-led growth phase, with buyers willing to commit capital to projects under construction, particularly apartment schemes. At the same time, the strong ready segment (37.6%) indicates that this is not a speculative-only market: there is consistent depth in move-in-ready stock, especially for end-users and yield-focused investors. |

| Taken together, apartments remain the backbone of daily liquidity, while villas provide an important higher-ticket layer on the ready side. As long as developers maintain pricing discipline and focus on livable layouts and well-chosen micro-locations, this blend of off-plan momentum and steady ready demand points to a market that is active, diversified, and still attracting capital across the risk spectrum. |

Recent Posts

Farzana Hamayon0 Comments

Binghatti Achieves Third Year of Record Profits on Strong Revenue Surge

Farzana Hamayon0 Comments

Dubai Real Estate Transactions as Reported on 03-Feb-2026

Farzana Hamayon0 Comments

Dubai Real Estate Market Analysis 02-Feb-2026

All Categories

Tags

best developers in Dubai

best places to invest Dubai 2025

best ROI communities Dubai

Business Bay ROI

buy property in Dubai

Downtown Dubai investment

Dubai developers

Dubai Golden Visa property

Dubai housing market

Dubai infrastructure projects

Dubai Marina property

Dubai Marina real estate

Dubai off-plan properties

Dubai property forecast 2030

Dubai property market

Dubai property market 2025

Dubai property trends

Dubai property values

Dubai real estate

Dubai real estate 2025

Dubai real estate investment

Dubai real estate investment opportunities

Dubai real estate market 2025

Dubai rental yields

Dubai South investment

Dubai South real estate

Emaar properties

first-time investor Dubai

Golden Visa Dubai#

Golden Visa property Dubai

high ROI communities Dubai

high ROI Dubai properties

invest in Dubai

invest in Dubai property

JVC investment

luxury properties Dubai

MBR City properties

Meydan Dubai ROI

off-plan projects Dubai

off plan properties Dubai

off plan vs ready property Dubai

Palm Jumeirah properties

real estate agents in Dubai

ROI projects Dubai

top developers Dubai

Contact our Experts

(Please share your contact details)