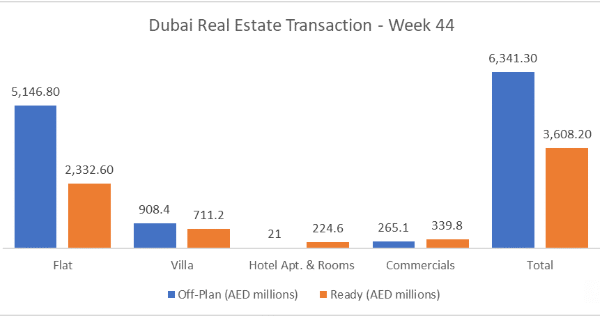

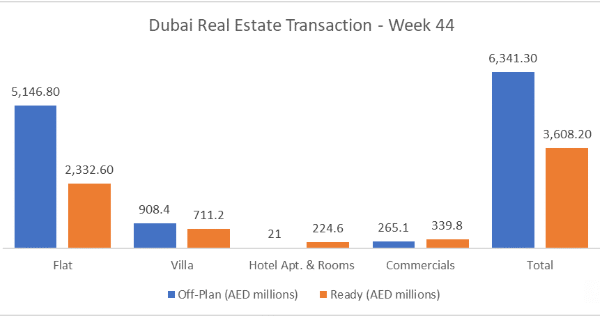

The total real estate transactions in Dubai for Week 44 was AED 9.95 billion across 5,225 transactions. ~0.5% dip in value and 7.0% increase in number of transactions from last week’s numbers. Off-plan contributed AED 6.34 billion (63.7%), while Ready accounted for AED 3.61 billion (36.3%).

| Category |

Off-Plan (AED millions) |

Ready (AED millions) |

| Flat |

5,146.8 |

2,332.6 |

| Villa |

908.4 |

711.2 |

| Hotel Apt. & Rooms |

21.0 |

224.6 |

| Commercials |

265.1 |

339.8 |

| Total |

6,341.3 |

3,608.2 |

Off-Plan Market Performance

|

| Total Value: AED 6.34 billion (63.7% of Weekly Total) |

| Category |

Value (AED billions) |

% of Off-Plan |

| Flat |

5.15 |

81.2% |

| Villa |

0.91 |

14.3% |

| Hotel Apt. & Rooms |

0.02 |

0.3% |

| Commercials |

0.27 |

4.2% |

|

| Off-plan activity this week was overwhelmingly driven by flats, which made up just over four-fifths of all off-plan value. Villas were the clear second pillar at 14%, reflecting continued appetite for villa communities. |

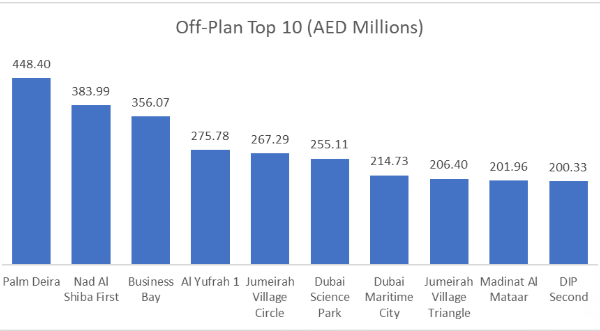

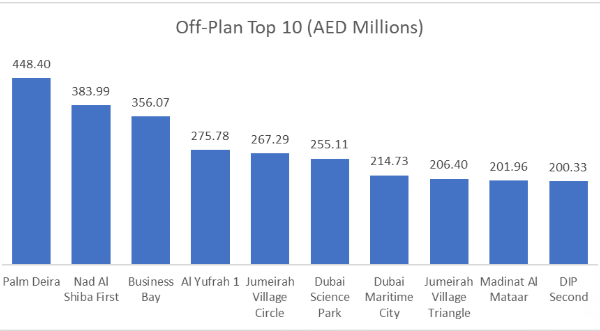

Top Performing Off-Plan Areas

|

| Area |

Value (AED millions) |

| Palm Deira |

448.4 |

| Nad Al Shiba First |

384.0 |

| Business Bay |

356.1 |

| Al Yufrah 1 |

275.8 |

| Jumeirah Village Circle |

267.3 |

|

Palm Deira and Nad Al Shiba First together cleared more than AED 800 million in off-plan value, signalling intense absorption in large-scale masterplan launches. JVC continue to act as volume engines for investors targeting mid-ticket stock with rental yield stories.

Ready Market Performance

|

| Total Value: AED 3.61 billion (36.3% of Weekly Total) |

| Category |

Value (AED billion) |

% of Ready |

| Flat |

2.33 |

64.6% |

| Villa |

0.71 |

19.7% |

| Hotel Apt. & Rooms |

0.22 |

6.2% |

| Commercials |

0.34 |

9.4% |

|

| Ready trading is still led by flats, which drove nearly two-thirds of all ready value this week. Villas remain strong at just under 20% of total ready activity, showing continued owner-occupier and upgrader demand for established villa communities. |

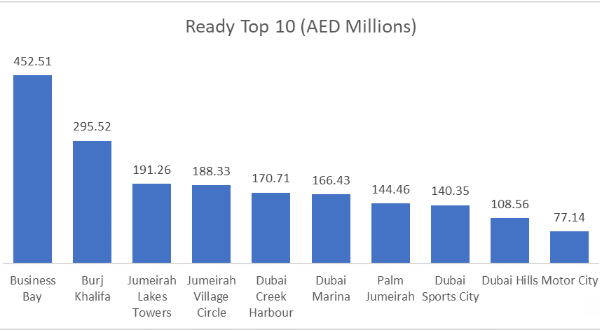

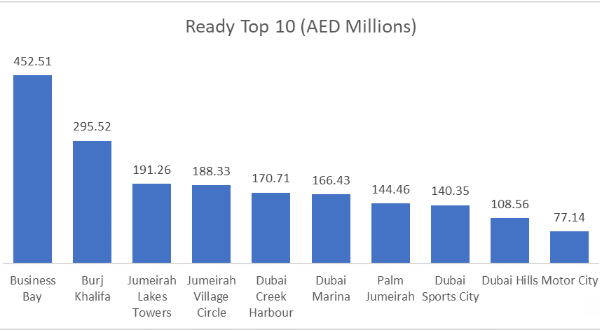

Top Performing Ready Areas

|

| Area |

Value (AED millions) |

| Business Bay |

452.5 |

| Burj Khalifa |

295.5 |

| Jumeirah Lakes Towers |

191.3 |

| Jumeirah Village Circle |

188.3 |

| Dubai Creek Harbour |

170.7 |

|

The ready market remains highly concentrated in core high-rise investment districts. Business Bay, Downtown (Burj Khalifa), and JLT alone accounted for well over AED 900 million in secondary activity, reinforcing central Dubai towers as highly liquid assets. JVC’s presence in both off-plan and ready tables shows it is a dual-market hub for investors: pre-handover and immediate rental stock.

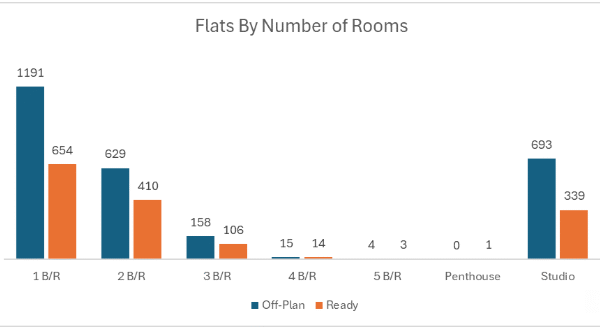

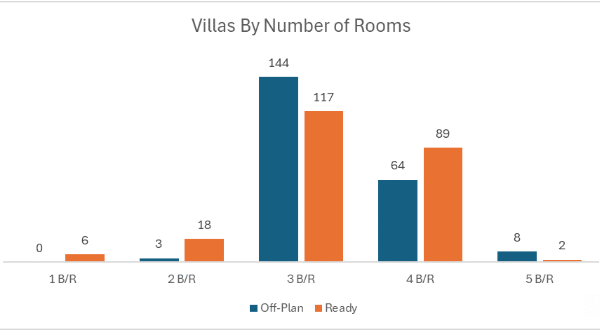

On the micro level

|

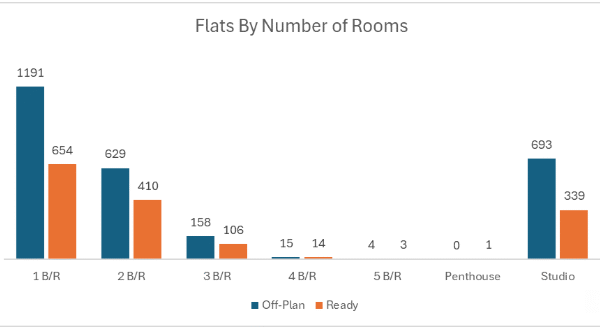

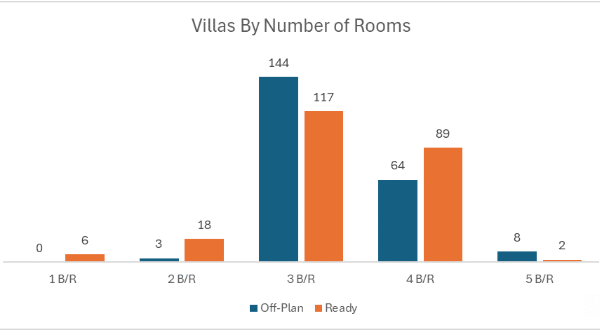

| Below is the sales distribution based on the number of bedrooms |

Weekly Comparison

|

| Metric |

Last Week |

This Week |

Change |

| Total Volume |

AED 10.00 bn |

AED 9.95 bn |

−0.5% |

| Number of Transactions |

4,882 |

5,225 |

+7.0% |

|

Market Insights & Outlook

|

| This was a liquidity-driven week. Headline value was slightly lower, but total deals were higher. That usually means the market is not slowing, it’s broadening. Activity is spreading into mid-ticket and yield-led communities rather than only chasing ultra-prime. |

| Off-Plan is still the main engine at 63.7% of total value, with flats alone representing 81.2% of that segment. Ready deals remain dominated by high-rise apartments in Business Bay, Downtown, JLT, Marina, and JVC, confirming that investors are still comfortable recycling capital into dense rental stock. |