Dubai Real Estate Transactions as Reported on 30th January 2026

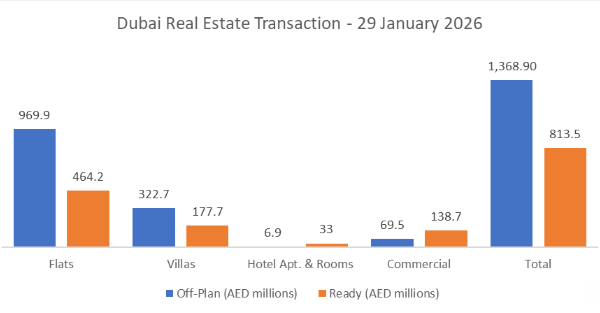

| On the 29-Jan-2026, the total transacted value reached AED 2.18B. Off-plan dominated with AED 1.37B (62.7%), while Ready accounted for AED 0.81B (37.3%). | ||||||||||||||||||

|

Off-Plan Market Performance |

| Total Value: AED 1.37B |

|

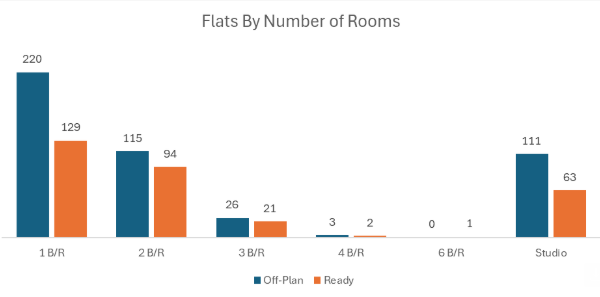

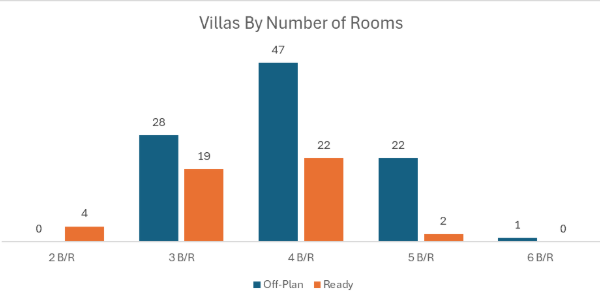

| Off-plan was overwhelmingly apartment-led, with villas providing a solid secondary pillar. |

Ready Market Performance |

| Total Value: AED 0.81B |

|

| Ready activity was more diversified, with a notably higher commercial share than off-plan. |

On The Micro Level

Market Insights & Outlook |

| Today’s tape reflects a classic Dubai split: off-plan momentum driven by apartment absorption, while the ready market shows broader participation, especially in commercial, which captured a meaningful 17% of ready value. If this mix persists, expect continued strength in end-user-friendly apartments alongside selective demand for income-oriented, immediately tradable ready assets. |

Recent Posts

Farzana Hamayon0 Comments

Binghatti Achieves Third Year of Record Profits on Strong Revenue Surge

Farzana Hamayon0 Comments

Dubai Real Estate Transactions as Reported on 03-Feb-2026

Farzana Hamayon0 Comments

Dubai Real Estate Market Analysis 02-Feb-2026

All Categories

Tags

best developers in Dubai

best places to invest Dubai 2025

best ROI communities Dubai

Business Bay ROI

buy property in Dubai

Downtown Dubai investment

Dubai developers

Dubai Golden Visa property

Dubai housing market

Dubai infrastructure projects

Dubai Marina property

Dubai Marina real estate

Dubai off-plan properties

Dubai property forecast 2030

Dubai property market

Dubai property market 2025

Dubai property trends

Dubai property values

Dubai real estate

Dubai real estate 2025

Dubai real estate investment

Dubai real estate investment opportunities

Dubai real estate market 2025

Dubai rental yields

Dubai South investment

Dubai South real estate

Emaar properties

first-time investor Dubai

Golden Visa Dubai#

Golden Visa property Dubai

high ROI communities Dubai

high ROI Dubai properties

invest in Dubai

invest in Dubai property

JVC investment

luxury properties Dubai

MBR City properties

Meydan Dubai ROI

off-plan projects Dubai

off plan properties Dubai

off plan vs ready property Dubai

Palm Jumeirah properties

real estate agents in Dubai

ROI projects Dubai

top developers Dubai

Contact our Experts

(Please share your contact details)