Dubai Real Estate Market Review 28th October 2025

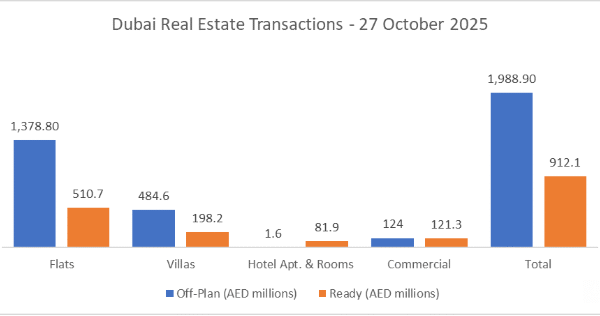

On 27-Oct-2025, the total transacted value reached AED 2,901,047,946. Off-plan clearly dominated. Off-plan contributed AED 1,988,908,395 (68.6%), while Ready accounted for AED 912,139,551 (31.4%).

| Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

| Flats | 1,378.8 | 510.7 |

| Villas | 484.6 | 198.2 |

| Hotel Apt. & Rooms | 1.6 | 81.9 |

| Commercial | 124.0 | 121.3 |

| Total | 1,988.9 | 912.1 |

Off-Plan Market Performance |

| Total Value: AED 1,988,908,395 |

| Flats: AED 1,378,750,509 (69.3%) Villas: AED 484,565,961 (24.4%) Hotel Apts & Rooms: AED 1,601,650 (0.1%) Commercial: AED 123,990,275 (6.2%) |

| Off-plan activity was led by flats, with villas contributing just under a quarter of spend and commercial providing additional depth. |

Ready Market Performance |

| Total Value: AED 912,139,551 |

| Flats: AED 510,696,399 (56.0%) Villas: AED 198,213,468 (21.7%) Hotel Apts & Rooms: AED 81,926,100 (9.0%) Commercial: AED 121,303,584 (13.3%) |

| Ready transactions were driven by flats, but hotel and commercial assets together made up over 22% of today’s ready spend. |

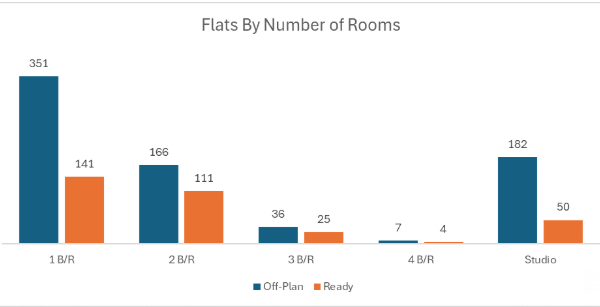

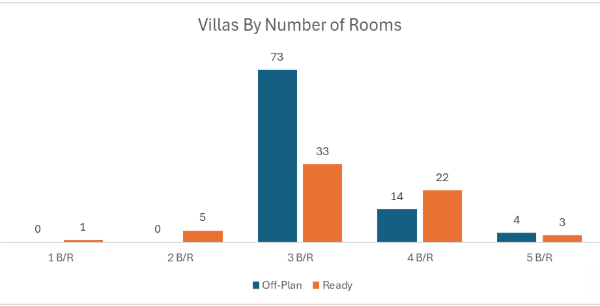

On The Micro Level

Market Insights & Outlook |

| The market is still developer-led. Nearly 69% of all money spent went into off-plan, reflecting investor appetite for future delivery and flexible payment plans. The ready market remains active in immediately rentable apartments and income-yielding hospitality/commercial stock. |

Recent Posts

Farzana Hamayon0 Comments

Binghatti Achieves Third Year of Record Profits on Strong Revenue Surge

Farzana Hamayon0 Comments

Dubai Real Estate Transactions as Reported on 03-Feb-2026

Farzana Hamayon0 Comments

Dubai Real Estate Market Analysis 02-Feb-2026

All Categories

Tags

best developers in Dubai

best places to invest Dubai 2025

best ROI communities Dubai

Business Bay ROI

buy property in Dubai

Downtown Dubai investment

Dubai developers

Dubai Golden Visa property

Dubai housing market

Dubai infrastructure projects

Dubai Marina property

Dubai Marina real estate

Dubai off-plan properties

Dubai property forecast 2030

Dubai property market

Dubai property market 2025

Dubai property trends

Dubai property values

Dubai real estate

Dubai real estate 2025

Dubai real estate investment

Dubai real estate investment opportunities

Dubai real estate market 2025

Dubai rental yields

Dubai South investment

Dubai South real estate

Emaar properties

first-time investor Dubai

Golden Visa Dubai#

Golden Visa property Dubai

high ROI communities Dubai

high ROI Dubai properties

invest in Dubai

invest in Dubai property

JVC investment

luxury properties Dubai

MBR City properties

Meydan Dubai ROI

off-plan projects Dubai

off plan properties Dubai

off plan vs ready property Dubai

Palm Jumeirah properties

real estate agents in Dubai

ROI projects Dubai

top developers Dubai

Contact our Experts

(Please share your contact details)