Dubai Real Estate Market Analysis 02-Feb-2026

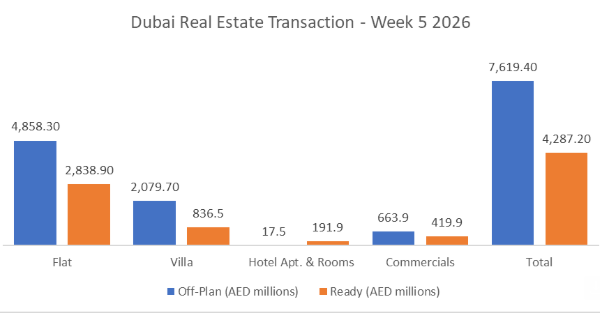

In Week 5, total trading reached AED11.91bn across 5,114 transactions. Off-Plan dominated with AED7.62bn (64.0%), while Ready accounted for AED4.29bn (36.0%).

| Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

| Flat | 4,858.3 | 2,838.9 |

| Villa | 2,079.7 | 836.5 |

| Hotel Apt. & Rooms | 17.5 | 191.9 |

| Commercials | 663.9 | 419.9 |

| Total | 7,619.4 | 4,287.2 |

Off-Plan Market Performance |

||||||||||||||||||

|

||||||||||||||||||

|

||||||||||||||||||

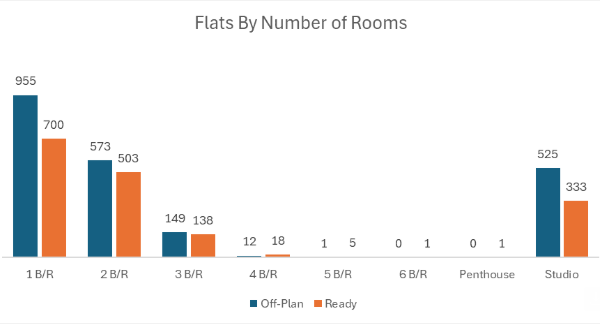

| Off-plan activity was flat-led, with flats alone contributing 40.8% of the entire week’s value (AED4.86bn out of AED11.91bn), while villas added another 17.5% of weekly value. | ||||||||||||||||||

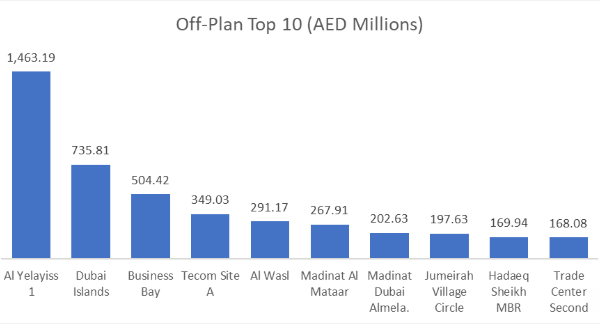

Top Performing Off-Plan Areas (Top 10) |

||||||||||||||||||

| The top 10 off-plan areas totaled AED4.35bn, representing 57.1% of all Off-Plan value (and 36.5% of the entire week). | ||||||||||||||||||

|

Ready Market Performance |

||||||||||||||||||

|

||||||||||||||||||

|

||||||||||||||||||

| The ready market was also flat-heavy, with flats contributing 23.8% of the total weekly value, while villas added 7.0%, a steadier, more end-user-leaning profile versus off-plan. | ||||||||||||||||||

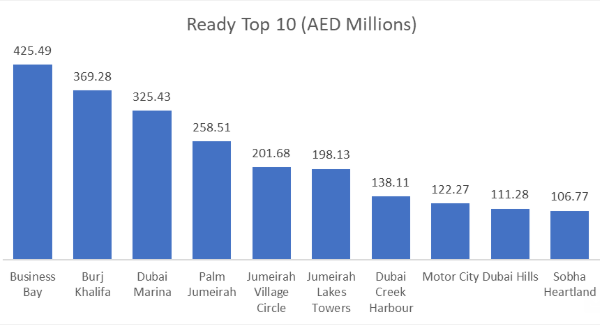

Top Performing Ready Areas (Top 10) |

||||||||||||||||||

| The top 10 ready areas totaled AED2.26bn, representing 52.6% of all Ready value (and 19.0% of the entire week). | ||||||||||||||||||

|

On the micro level

Weekly Comparison |

||||||||||||

|

||||||||||||

Market Insights & Outlook |

||||||||||||

| Week 5 delivered a clear acceleration versus last week, with both value (+10.1%) and transaction count (+11.3%) moving higher. The market remained off-plan-led (64%), driven primarily by flat absorption (63.8% of off-plan) and supported by a meaningful villa component (27.3%). Concentration was notable: the top 10 off-plan areas captured 57% of off-plan value, indicating demand is clustering around a handful of high-liquidity districts and launch corridors. On the ready side, activity stayed anchored in established hubs (led by Business Bay, Burj Khalifa, and Dubai Marina), with a balanced spread across lifestyle and prime addresses, suggesting end-user and investor demand are both active, but off-plan remains the week’s main engine. |

Recent Posts

Farzana Hamayon0 Comments

Binghatti Achieves Third Year of Record Profits on Strong Revenue Surge

Farzana Hamayon0 Comments

Dubai Real Estate Transactions as Reported on 03-Feb-2026

Farzana Hamayon0 Comments

Dubai Real Estate Market Analysis 02-Feb-2026

All Categories

Tags

best developers in Dubai

best places to invest Dubai 2025

best ROI communities Dubai

Business Bay ROI

buy property in Dubai

Downtown Dubai investment

Dubai developers

Dubai Golden Visa property

Dubai housing market

Dubai infrastructure projects

Dubai Marina property

Dubai Marina real estate

Dubai off-plan properties

Dubai property forecast 2030

Dubai property market

Dubai property market 2025

Dubai property trends

Dubai property values

Dubai real estate

Dubai real estate 2025

Dubai real estate investment

Dubai real estate investment opportunities

Dubai real estate market 2025

Dubai rental yields

Dubai South investment

Dubai South real estate

Emaar properties

first-time investor Dubai

Golden Visa Dubai#

Golden Visa property Dubai

high ROI communities Dubai

high ROI Dubai properties

invest in Dubai

invest in Dubai property

JVC investment

luxury properties Dubai

MBR City properties

Meydan Dubai ROI

off-plan projects Dubai

off plan properties Dubai

off plan vs ready property Dubai

Palm Jumeirah properties

real estate agents in Dubai

ROI projects Dubai

top developers Dubai

Contact our Experts

(Please share your contact details)