Dubai Real Estate Market Review: January 2026

| January 2026 closed with a total traded value of AED104.09B across 21,707 transactions, nearly double January 2025’s AED54.08B (+92.5% YoY). The month’s headline feature was Land, which accounted for the majority of value, while Off-Plan remained the strongest built-property engine by traded value. | ||||||||||||||||||

|

Market Composition |

|||||||||||||||

|

|||||||||||||||

Off-Plan Market Performance |

|||||||||||||||

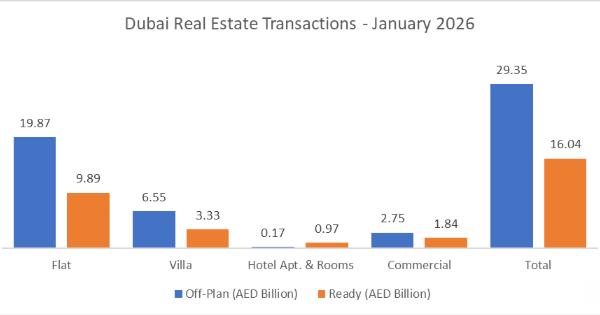

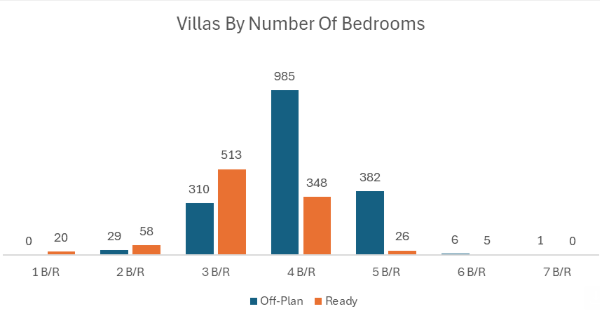

| Total Off-Plan Value: AED29.35B (28.2% of the month) Off-plan was led overwhelmingly by Flats, which made up over two-thirds of off-plan value. |

|||||||||||||||

|

|||||||||||||||

| January’s off-plan market was essentially a flat-driven, with villas a solid secondary pillar and commercial meaningful but clearly third. The highest ticket value for flats was Island 2 – AED80.0M, and for villas was The World – AED71.44M. | |||||||||||||||

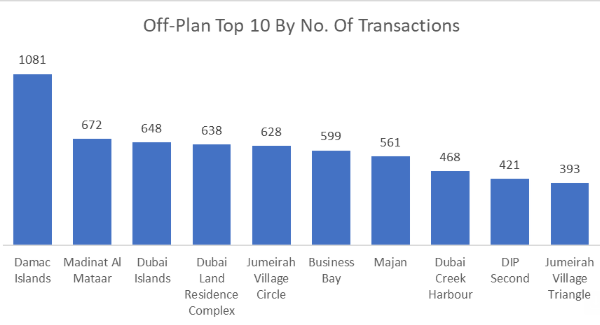

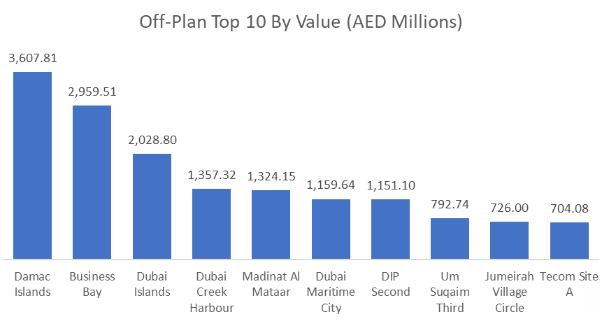

Top Performing Areas |

|||||||||||||||

|

| Area | Value Traded (AED Billion) |

|---|---|

| Damac Islands | 3.61 |

| Business Bay | 2.96 |

| Dubai Islands | 2.03 |

| Dubai Creek Harbour | 1.36 |

| Madinat Al Mataar | 1.32 |

Ready Market Performance |

|||||||||||||||

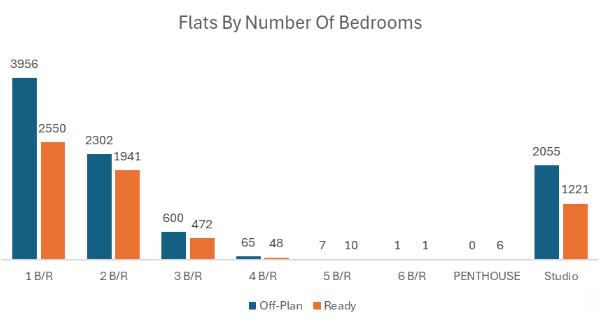

| Total Ready Value: AED16.04B (15.4% of the month) Ready also skewed toward flats, but with a noticeably higher share for Hotel Apt. & Rooms versus off-plan. |

|||||||||||||||

|

|||||||||||||||

| Ready demand remained broad-based, with flats leading, and hotel/room product showing a more material footprint than in off-plan. The highest ticket value for flats was Jumeirah Bay – AED71.90M, and for villas was Palm Jumeirah – AED220.0M. | |||||||||||||||

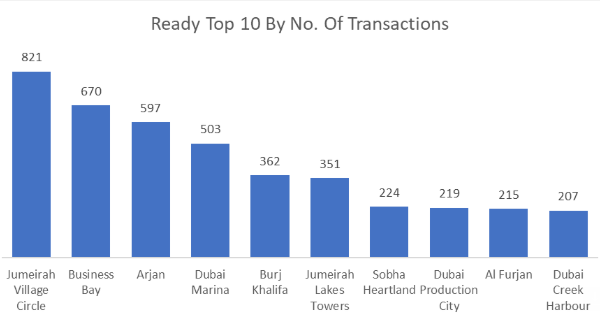

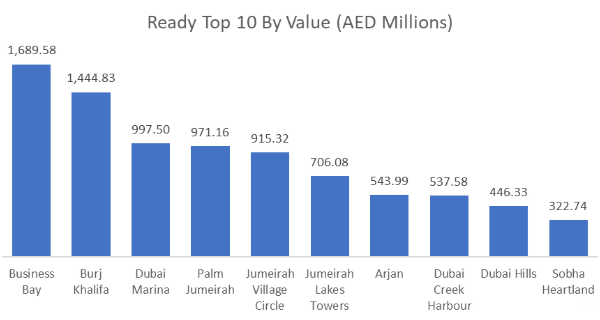

Top Performing Areas |

|||||||||||||||

|

| Area | Value Traded (AED Billion) |

|---|---|

| Business Bay | 1.69 |

| Burj Khalifa | 1.44 |

| Dubai Marina | 1.00 |

| Palm Jumeirah | 0.97 |

| Jumeirah Village Circle | 0.92 |

On The Micro Level

Market Insights & Outlook |

| January 2026 printed an exceptional headline (AED104.09B, +92.5% YoY) primarily because Land dominated the value stack (56.4%), amplified by at least one ultra-ticket transaction. Underneath that, the built market stayed structurally consistent: flats led both off-plan and ready, with off-plan showing stronger recently launched concentration (top projects = ~19.4% of off-plan value) and ready reflecting broader distribution (top projects = ~9.7% of ready value). If land intensity normalizes in the following months, the key question becomes whether off-plan launch velocity (e.g., Damac Islands scale) can sustain overall market value at elevated levels without relying on land’s outsized contribution. |

Recent Posts

Farzana Hamayon0 Comments

Dubai Residential Property Transactions Hit AED 55.18bn in January 2026 (+43.9%)

Farzana Hamayon0 Comments

Dubai Real Estate Transactions as Reported on 6th February 2026

Farzana Hamayon0 Comments

Dubai Real Estate Transactions as Reported on 5th February 2026

All Categories

Tags

best developers in Dubai

best places to invest Dubai 2025

best ROI communities Dubai

Business Bay ROI

buy property in Dubai

Downtown Dubai investment

Dubai developers

Dubai Golden Visa property

Dubai housing market

Dubai infrastructure projects

Dubai Marina property

Dubai Marina real estate

Dubai off-plan properties

Dubai property forecast 2030

Dubai property market

Dubai property market 2025

Dubai property trends

Dubai property values

Dubai real estate

Dubai real estate 2025

Dubai real estate investment

Dubai real estate investment opportunities

Dubai real estate market 2025

Dubai rental yields

Dubai South investment

Dubai South real estate

Emaar properties

first-time investor Dubai

Golden Visa Dubai#

Golden Visa property Dubai

high ROI communities Dubai

high ROI Dubai properties

invest in Dubai

invest in Dubai property

JVC investment

luxury properties Dubai

MBR City properties

Meydan Dubai ROI

off-plan projects Dubai

off plan properties Dubai

off plan vs ready property Dubai

Palm Jumeirah properties

real estate agents in Dubai

ROI projects Dubai

top developers Dubai

Contact our Experts

(Please share your contact details)