Dubai Real Estate Transactions as Reported on 12th February 2026

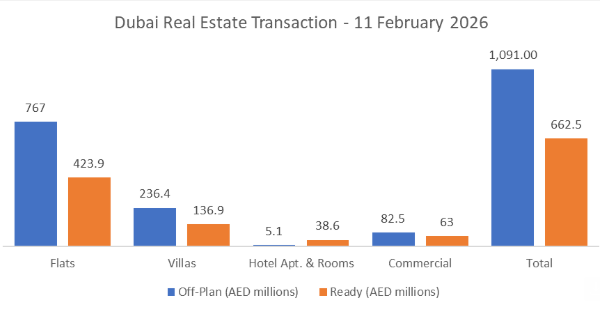

On the 11-Feb-2026, the total transacted value reached AED 1.75bn. Off-plan dominated with AED 1.09bn (62.2%), while Ready accounted for AED 0.66bn (37.8%).

| Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

| Flats | 767.0 | 423.9 |

| Villas | 236.4 | 136.9 |

| Hotel Apt. & Rooms | 5.1 | 38.6 |

| Commercial | 82.5 | 63.0 |

| Total | 1,091.0 | 662.5 |

Off-Plan Market Performance |

| Total Value: AED 1.09bn |

|

| Off-plan activity was overwhelmingly flat-led, with villas providing a strong secondary layer of demand. |

Ready Market Performance |

| Total Value: AED 662.5m |

|

| In the ready market, flats remained the anchor, while commercial and hotel units added meaningful depth to turnover. |

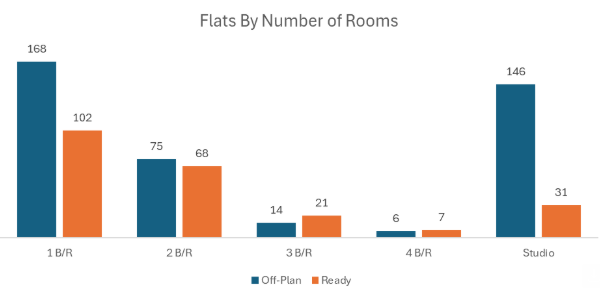

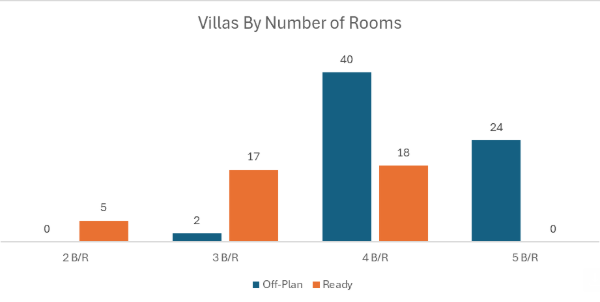

On The Micro Level

Market Insights & Outlook |

| The day’s performance reflects a clear preference for off-plan exposure, with flats driving the bulk of value across both segments. Ready activity remained solid and more diversified, suggesting steady end-user and investor demand, while off-plan continues to capture momentum through scale and pricing breadth. |

Recent Posts

Farzana Hamayon0 Comments

Mercedes-Benz Places at Binghatti City | Off-Plan Luxury Branded Homes in Dubai

Farzana Hamayon0 Comments

Dubai Real Estate Transactions as Reported on 12th February 2026

Farzana Hamayon0 Comments

Dubai Real Estate Transactions as Reported on 10th February 2026

Tags

best developers in Dubai

best places to invest Dubai 2025

best ROI communities Dubai

Business Bay ROI

buy property in Dubai

Downtown Dubai investment

Dubai developers

Dubai Golden Visa property

Dubai housing market

Dubai infrastructure projects

Dubai Marina property

Dubai Marina real estate

Dubai off-plan properties

Dubai property forecast 2030

Dubai property market

Dubai property market 2025

Dubai property trends

Dubai property values

Dubai real estate

Dubai real estate 2025

Dubai real estate investment

Dubai real estate investment opportunities

Dubai real estate market 2025

Dubai rental yields

Dubai South investment

Dubai South real estate

Emaar properties

first-time investor Dubai

Golden Visa Dubai#

Golden Visa property Dubai

high ROI communities Dubai

high ROI Dubai properties

invest in Dubai

invest in Dubai property

JVC investment

luxury properties Dubai

MBR City properties

Meydan Dubai ROI

off-plan projects Dubai

off plan properties Dubai

off plan vs ready property Dubai

Palm Jumeirah properties

real estate agents in Dubai

ROI projects Dubai

top developers Dubai

Contact our Experts

(Please share your contact details)